Forestry company in China and Brazil

Context: A forestry company with holdings in China and Brazil has decided to investigate potential new value pools that could be unlocked in the next fifteen to twenty years for the business. The executive board agrees that the climate transition has the potential to significantly impact the forestry sector, so they decide to use climate scenario analysis to assist in the new value pool identification process. One value pool of particular interest to the company is carbon sequestration credits, which could provide a revenue source in the future.

Selecting scenarios

The team selects three scenarios from the WBCSD Climate Scenario Tool that represent a wide range of potential climate transition pathways for society. Because the carbon sequestration outputs are all relative to a Business as Usual Scenario, the team selects three other climate scenarios:

<2° Forecast Policy Scenario (IPR)

Meaningful action towards curbing global warming, including greenhouse gas (GHG) prices and area protection, and a scale up of bioenergy with carbon capture and storage (BECCS) capacity starting around 2030

<2°C Coordinated Policy Scenario

A scenario in which timely policy and regulation work to curb emissions in an orderly fashion, decreasing the physical risk of climate change, but increasing the transition risk.

1.5°C Societal Transformation Scenario

A policy driven scenario in which strong, coordinated and prompt global policy action, as well as market responses (e.g., diet shifts and lower food waste), result in widespread carbon pricing and land protection to enable decarbonization and limit the physical impacts of climate change.

The tool in use

Extracting what’s most relevant

The Climate Scenario Tool allows users to select both business and environmental variables across scenarios and regions. In this case, the analyst chooses to examine Forest-based Mitigation of Forest Restoration in select regions.

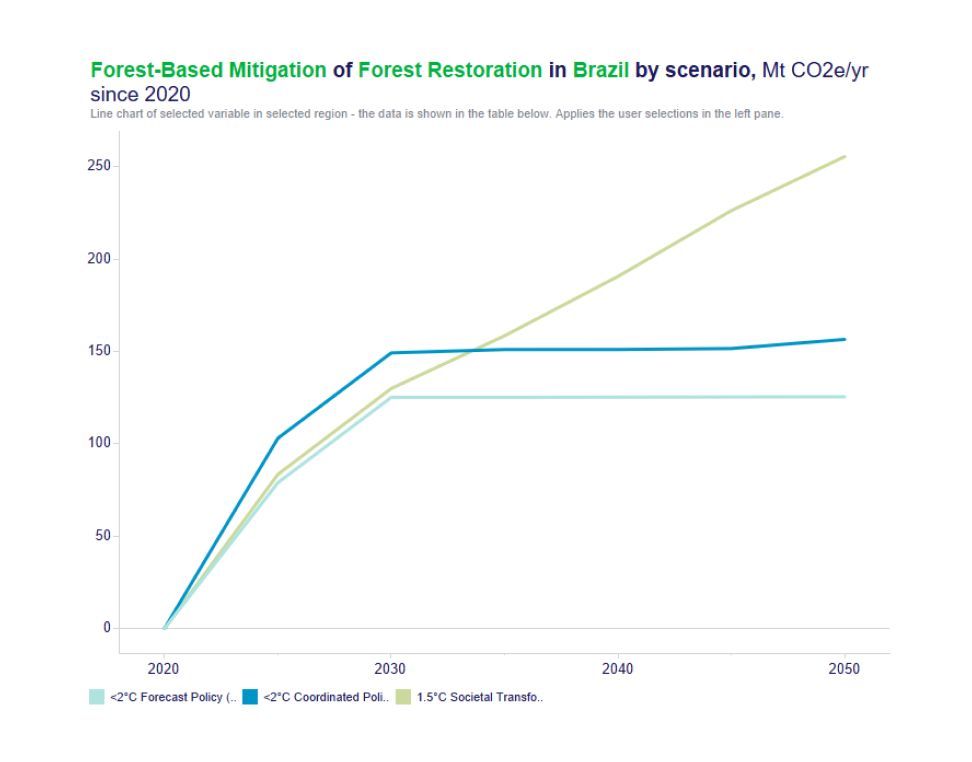

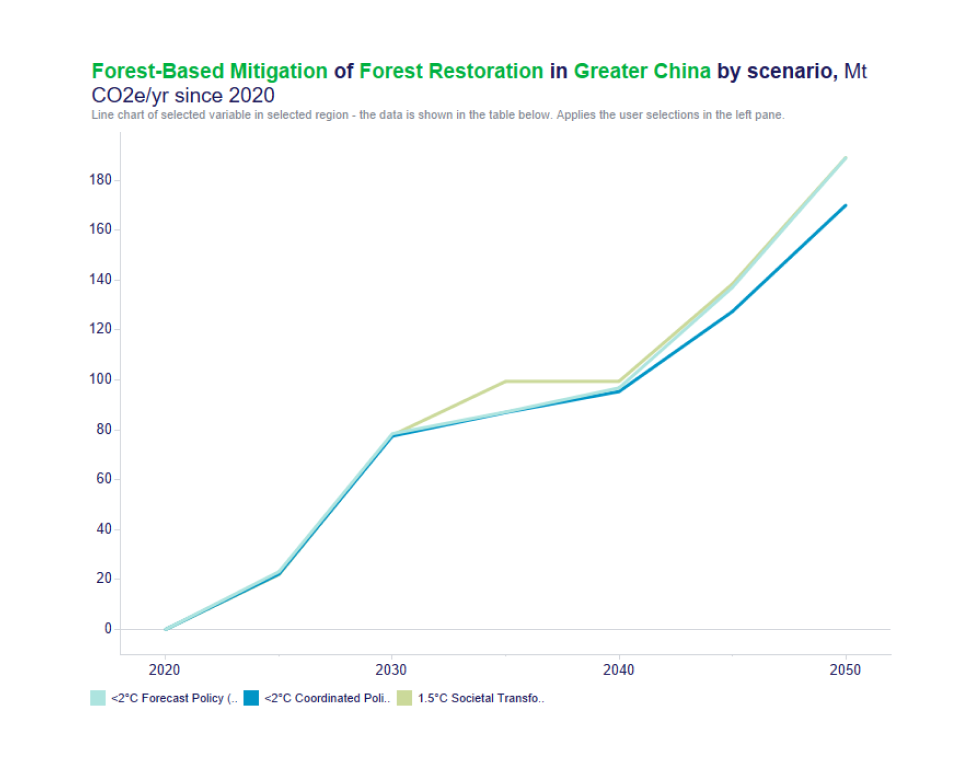

After selecting these three scenarios, an analyst begins to explore the data, first looking at the potential changes in carbon sequestration in Brazil and Greater China.

For Brazil, the analyst notes that CO2 sequestration experiences an initial upshoot across all three scenarios between 2020 and 2030. However, for the <2oC scenarios, sequestration due to forest restoration levels off around 2030, while for the 1.5oC it continues to rise at a similar rate.

In contrast, in Greater China, CO2 sequestration increases considerably in all three scenarios following a similar pattern. In particular, sequestration increases at a rapid rate between 2020 and 2030, following which it slows down from 2030-2040 before its rate of growth picking up again from 2040-2050.

What are the implications?

These trends suggest potential implications for the company based on their specific characteristics, market position, and strategic goals:

Analysis

First, the analyst looks at the CO2 sequestration trajectories of the different scenarios to understand if there is a potential future value pool for carbon sequestration credits in general. Under these scenarios, in particular under the 1.5°C scenario in Brazil and all three scenarios in Greater China, there is a significant increase in CO2 sequestration. This increase suggests that there is significant potential for demand for carbon sequestration credits in the future. This finding allows the analyst to prove to the sustainability team that it is worth further investigating the value pool. Additionally, the analyst notes that under all scenarios there is a significant initial increase in carbon sequestration from 2025-2030, suggesting that early movers on carbon sequestration may benefit the most under these scenarios.

Next, the analyst decides to assess the potential value pools for CO2 sequestration in both regions for the company. Working with the broader sustainability team, she uses the company’s holding data to identify how much land could potentially be available for sequestration projects in the future. Next, she multiplies the sequestration potential of their holdings by the GHG price trajectories that underlie the scenarios to calculate the potential increase in revenue from carbon credits.

Outcome

These findings are ultimately presented to the company’s executive team. The executive team is impressed with the potential increase in revenue due to carbon sequestration credits. Based on this research, the executive team asks the CSO to create a taskforce to further explore the potential future of the carbon sequestration credit market in China and Brazil, as well as the company’s potential monetization opportunities.